Prime Minister Trudeau outlines Canada’s whole-of-government response to COVID-19 across the country, including new investments to respond in Canada and around the world.

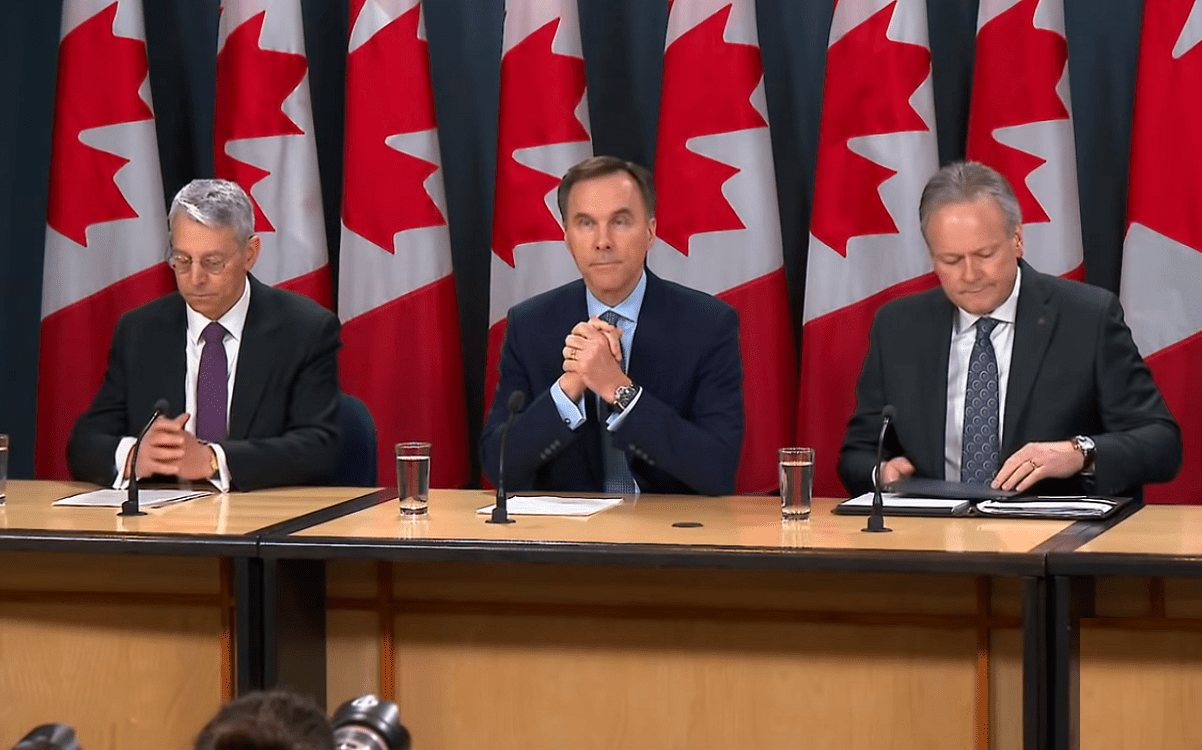

Finance Minister Bill Morneau, Governor of the Bank of Canada Stephen Poloz, and Superintendent of Financial Institutions Jeremy Rudin outlined a coordinated package of measures being taken by financial sector partners to support the functioning of markets and continued access to financing for Canadian businesses.

At this time of global uncertainty, Canadians can be assured that the government is committed to addressing the challenges faced by individuals and businesses.

While Canada’s financial sector remains sound, well-capitalized and resilient, the government and its partners are taking action to ensure that Canadian families are safe, jobs are protected and the economy remains strong.

To support businesses during this extraordinary time, the government is establishing a Business Credit Availability Program (BCAP). The program will further support financing in the private sector through the Business Development Bank of Canada (BDC) and Export Development Canada (EDC). Under this program, BDC and EDC will enhance their cooperation with private sector lenders to coordinate financing and credit insurance solutions for Canadian businesses.

This will allow BDC and EDC to provide more than $10 billion of additional support to businesses.

The Office of the Superintendent of Financial Institutions (OSFI) is lowering the Domestic Stability Buffer requirement for domestic systemically important banks by 1.25% of risk-weighted assets, effective immediately. This action will increase the lending capacity of Canada’s large banks and support the supply of credit to the economy during the period of disruption related to COVID-19. The release of the buffer will support in excess of $300 billion of additional lending capacity.

The Bank of Canada is committed to providing sufficient liquidity to the Canadian financial system and to supporting business and consumer confidence.

Today, the Bank announced a new Bankers’ Acceptance Purchase Facility. This will support a key funding market for small- and medium-sized businesses at a time when they may have increased funding needs and credit conditions are tightening.

On Thursday, the Bank announced it is broadening the scope of the Government of Canada bond buyback program to add market liquidity and support price discovery. The Bank also committed to proactively support interbank funding by temporarily adding new Term Repo operations with terms of 6 and 12 months, in addition to its regular 1-month and 3-month Term Repo operations.

In the coming weeks, the Bank of Canada will launch the Standing Term Liquidity Facility (STLF). Announced in November 2019, the STLF complements the Bank’s current tools for the provision of liquidity and will strengthen the Bank’s efforts to enhance the resilience of the Canadian financial system. Under the STLF, the Bank could provide loans to eligible financial institutions in need of temporary liquidity support and where the Bank has no concerns about their financial soundness.

Canadian financial institutions play an essential role in the stability and health of Canada’s financial system and economy. In the face of current global developments, financial institutions should focus on managing this uncertainty rather than devoting resources to previously announced regulatory changes.

OSFI also announced it will suspend all consultations on regulatory matters, including on the proposed new Benchmark Rate for the minimum qualifying rate for uninsured mortgages until conditions stabilize. As a result, the government is suspending the coming into force of the new Benchmark Rate for the minimum qualifying rate for insured mortgages until further notice.

In addition to actions by financial sector authorities, Minister Morneau has been in regular communication with the CEOs of Canada’s large banks, who have confirmed that government actions to support functioning markets will help maintain the flow of lending to Canadian business.

Canadian banks recognize the negative impact that COVID-19 may be having on some of their customers. They have made a commitment to the government that they will support businesses and individuals through these difficult times. Businesses that may be facing hardship are encouraged to contact their financial service providers early on.