The inseparable bond between economics and politics has long dictated the direction of societies, revealing that sound governance fosters robust economies, while poor decisions lead to turmoil. The 2008 financial crisis stands as a glaring example of how political influence over financial regulations can have disastrous consequences.

In the lead-up to the crisis, pressure from powerful investors and corporations compelled regulators and governments to adopt lax financial laws. These weakened regulations were designed to benefit a select few, allowing for risky financial practices that ultimately inflated the housing bubble. When the bubble burst, the ensuing collapse underscored the devastating impact of these misguided choices.

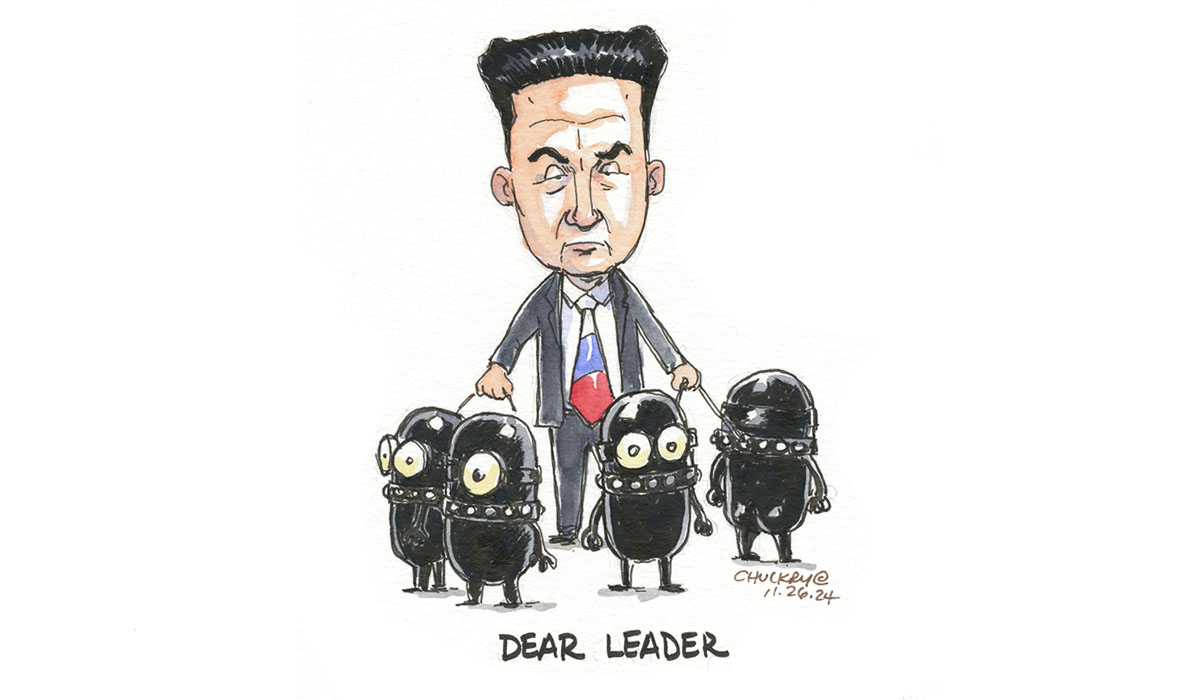

Politicians, motivated by the financial backing of wealthy donors and lobbyists, often enact measures that favor the interests of the rich and powerful. This cyclical relationship ensures that economic and political spheres remain tightly interwoven, as those with money wield significant influence over decisions. Consequently, financial strategies frequently reflect the priorities of the affluent, leading to systemic vulnerabilities that can trigger widespread instability.

Today, the patterns that precipitated the 2008 crisis persist. The global elites continue to shape policy through their substantial economic clout, perpetuating a cycle where financial gains for the few come at the expense of stability for the many. This enduring dynamic underscores the notion that governance and financial interests can never be fully separated, as money and power invariably drive decision-making processes.

In the wake of the 2008 crisis, the Obama administration introduced the Dodd-Frank Wall Street Reform and Consumer Protection Act to prevent future financial collapses. Dodd-Frank aimed to increase transparency and accountability in the financial system, imposing stricter regulations on banks to safeguard against risky behavior. However, during the Trump administration, many of these safeguards were rolled back, weakening the protections put in place. The consequences of these rollbacks became evident when major banks collapsed in 2023 and 2024, proving once again the critical importance of stringent financial regulations.

The implications of this entanglement are profound. The concentration of wealth and influence among a small group not only distorts economic strategies but also undermines democratic principles. The sway of lobbyists and big-money donors over political agendas diminishes the voice of the average citizen, creating an environment where measures are crafted to benefit the few rather than the collective good.

Despite the glaring need for reform, the entrenched power structures make meaningful change elusive. The intertwining of money and governance ensures that those who benefit from the status quo will resist efforts to alter it. As a result, the potential for future financial collapses remains a constant threat, driven by the same forces that led to past crises.

While it is tempting to hold on to optimism, the reality is that the profound influence of money and power in politics makes it difficult to envisage a solution to this enduring problem. The entanglement of governance and financial interests is a reflection of human nature’s susceptibility to greed and ambition, ensuring that the pursuit of wealth and influence will continue to shape our financial and political landscapes.

The relationship between governance and financial stability are inextricable link. As long as political decisions are swayed by the interests of the powerful, the potential for instability remains. The enduring influence of money and power demands vigilance and reform to combat systemic corruption and prevent future crises. It is imperative that we recognize and address this entanglement, for only then can we hope to build a more equitable and resilient future.