MPI’s Autopac Monopoly, Makes It Judge and Jury

- TDS News

- Breaking News

- Western Canada

- January 24, 2023

Manitobans pay the price for MPI’s mismanagement, prompting calls for greater oversight of the Crown Corporation

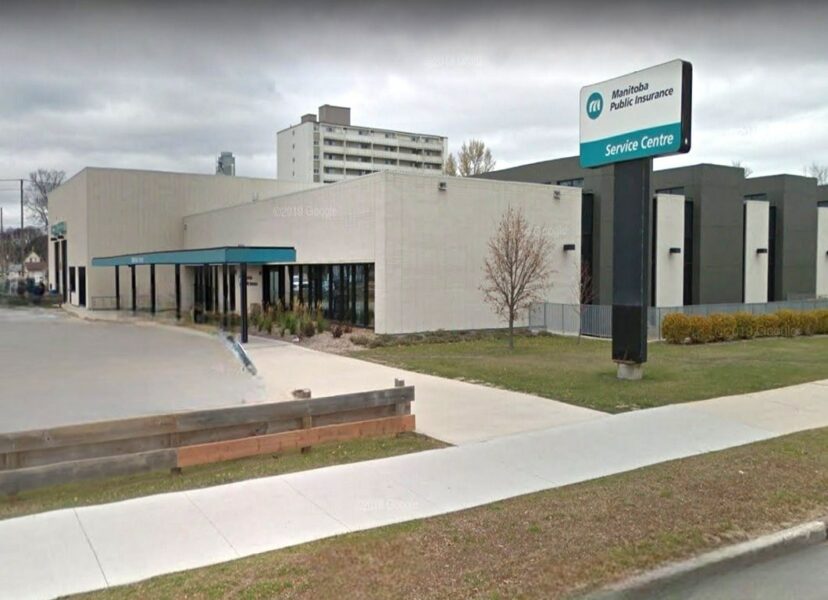

For decades Manitoba Public Insurance (MPI) has been the only source of auto insurance in the province, essentially making it a monopoly. There are a few opportunities for Manitobans to purchase top-up insurance through third parties, but those are insignificant purchases to warrant threatening MPI’s monopoly.

Since they are the province’s sole provider of auto insurance, they are essentially the judge, the jury and the executioner when it comes to Manitobans filing a claim. Although there are opportunities to appeal to an arbitrator or upper management of the crown Corporation, it does not dismiss the fact they are the only game in town. This lack of competition makes it hard for Manitobans to feel they are getting the best rates, coverages and customer service possible.

In December of 2022, a mother of two dropped off her youngest daughter to Cadets when she became a victim of a violent hit-and-run on the corner of Arlington and Dufferin.

According to the victim, she was stopped at the red light of Arlington and Dufferin in the left turning lane behind two vehicles. She observed in her rearview mirror a Black Dodge Ram truck approaching at an alarming speed with no indication it would stop.

Fearing the worst, a fatality or a severe injury from a rear-end collision pushing her vehicle into those ahead of her, and causing a multiple-car pile up into a busy intersection, would have been catastrophic. The mother tried to get out of the way by moving to the left lane attached to a wholesale parking lot, seeing as the right lane was occupied by parked cars, but she was not fast enough. The speeding truck hit the passenger side bumper, shattering the tail light on impact. It then swerved into the curb lane ahead and stopped at the red light.

Shaken, the mother safely pulled her vehicle behind the truck and parked, expecting he would get out of his vehicle to exchange information, but he did not. She waited maybe a minute behind the truck and had the instinct, before exiting her vehicle, to take a photo of the truck’s license plate.

The mother observed what looked like a heated conversation taking place between the truck driver and his passenger. What happened next was sheer moments of terror. The driver put the truck in reverse and rammed the mother’s vehicle, pushing her backwards.

The mother began to scream while leaning on the horn and her foot on the break, hoping the terror would stop or she could safely escape this life-threatening situation. Thankfully for her, neither of her children was in the vehicle at the time of the accident.

The driver of the Black Dodge Ram then made a right turn onto Arlington and stopped. The mother, distraught and still shaken, cautiously turned onto Arlington, watched the driver speed away, and turned off onto a side street, where she immediately proceeded to call 911. The 911 operator told her that the license plate she reported matched the Black Dodge Ram truck. However, no reports of an arrest were made.

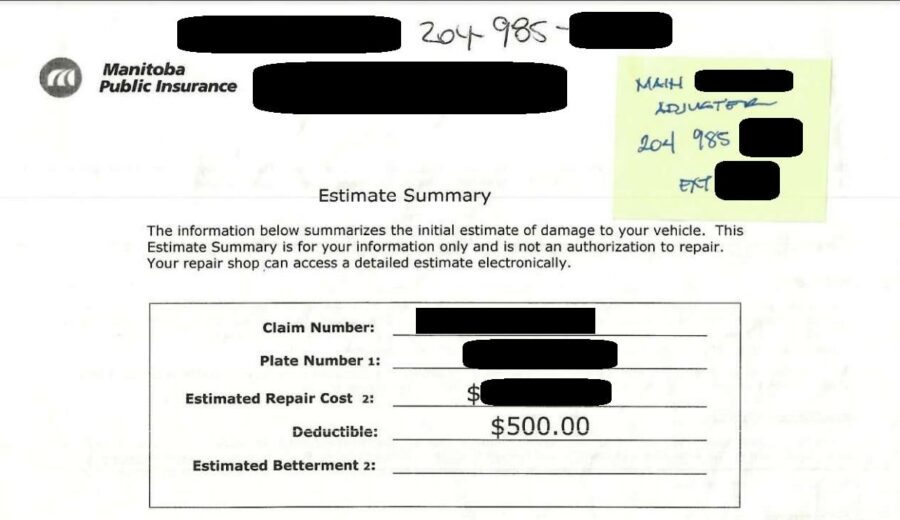

The mother contacted MPI to make a claim and was instructed by email to take her vehicle to an MPI collision centre for an assessment. During the assessment, the mother discussed the incident with a vehicle assessor at MPI’s garage on Main St. He then returned with an incorrect deductible on the assessment. She asked him if he was sure it was accurate, as her deductible on her registration said $200. Rather than argue and try to convince the MPI agent he was providing inaccurate information, she told him she would sort it out with the adjuster.

On December 19, 2022, ten days after the hit and run, the mother was contacted by an MPI Adjuster to retake her statement to recount the incident. She asked the MPI adjuster if she could proceed with the repairs and confirmed that the deductible was $200, not the incorrect amount issued by the person at the MPI collision centre.

The adjuster told the mother that she needed to wait to have the vehicle repaired as the MPI person who assessed the damages noted that the damages did not match her account of the incident. The mother was stunned. The adjuster indicated that Police reports could take up to 30 days, so that she will have more information about that. In other words, it sounds like they were waiting to see if the victim’s eyewitness account of the accident matched the Police report.

Upon making her claim with MPI, the mother’s ordeal dealing with the crown Corporation was anything short but embarrassing for the government. According to the mother, a series of events, comments and blunders made what was supposed to be a routine filing of a claim a painful ordeal.

Especially when they were aware that the mother immediately contacted 911 to report the hit-and-run, and the 911 operator informed her they had dispatched the vehicle description and information to patrol cars within the area. Even armed with that pertinent information, MPI dared to question the victims’ eyewitness accounts, especially when they were not present.

1. Assessment – MPI claims the assessors informed the adjuster that the mother’s eyewitness account did not match the damages they believed the vehicle should have sustained.

Has it become MPI’s policy to assume a person is making false claims unless they prove otherwise? Because if it is, it’s pretty troubling. Considering the mother has no history of making false claims with MPI. Clearly, it is not MPI’s policy to make a victim feel belittled after a life-threatening incident. It does, however, raise questions as to the Crown Corporations policies and training.

Understandably, MPI goes through many fraud cases each year, and those that try to manipulate the system should get their day in court. However, it is not an unrealistic hypothesis to believe MPI hase made adjusting errors due to the sheer volume of claims it processes each year. We’ve heard from people who have had their claims denied because of MPI’s wrong assertion of what they believe the type of damages should occur to a vehicle in a particular kind of accident. One thing that seemed consistent was rear-ended collision assessments.

One Winnipeg driver informed us they were rear-ended on Lagimodeire at a stop light. The vehicle ahead of them reversed into traffic and caused significant damage to their vehicle. The claim was reported to MPI, and they were deemed at fault because the eyewitness account did not match the MPI assessment of the damages should occur.

What this sounds like is a system with issues and a blind spot for assessing certain types of collisions., and it needs to be re-examined from top to bottom for how they conduct assessments, to taking statements and asserting their opinions.

2. Incorrect Deductible – When the mother’s claim was assessed, the claims department insisted that her deductible was $500, despite her repeated corrections. Her registration clearly shows she has a $200 deductible and has been paying into it for years, so being told in writing her deductible is $500 is inexcusable.

If MPI could get something as little as an incorrect deductible, is it plausible to think they got the whole case wrong? Errors are always made, and it’s human nature; however, when you have a computer and access to a person’s registration information, significant mistakes such as this should never happen. To be dismissive of an insured’s word again, insisting they are wrong, is unacceptable.

3. Processing Time – It has been over a month since the initial report of the accident, and the mother is unsure of the complete status of her claim situation.

This is unacceptable. Waiting over a month to have a claim settled, regardless if your vehicle is drivable or not, is not the definition of good customer service or a speedy claims process. Even if there is an aspect of involvement with the Police, the process needs to be re-evaluated.

4. Recording The Accident – Arguably, the most troubling and disturbing comment was made by an MPI adjuster when they asked the mother why she didn’t take out her cell phone and started recording the driver ramming her vehicle.

The thought of an MPI adjuster asking a Manitoban why they did not reach for their phone and start recording an accident while it was in progress is shocking and unsettling. The mother’s first response, a fight or flight in a life threatening moment, was not should she take out her phone and start recording while she was being rammed by a truck. It was about how she could safely get out of this dangerous situation.

MPIs handling of this case is problematic and makes you wonder how many Manitobans have experienced similar situations when dealing with the Crown Corporation.

It’s important to note we reached out to MPI for a comment to the allegations by the mother, but we did not receive a response.

The question now is, what does the government do with MPI? How can the current and future governments keep the parts of the system that work while fixing the ones lacking? It would be inaccurate to assert there are no good aspects of MPI, such as;

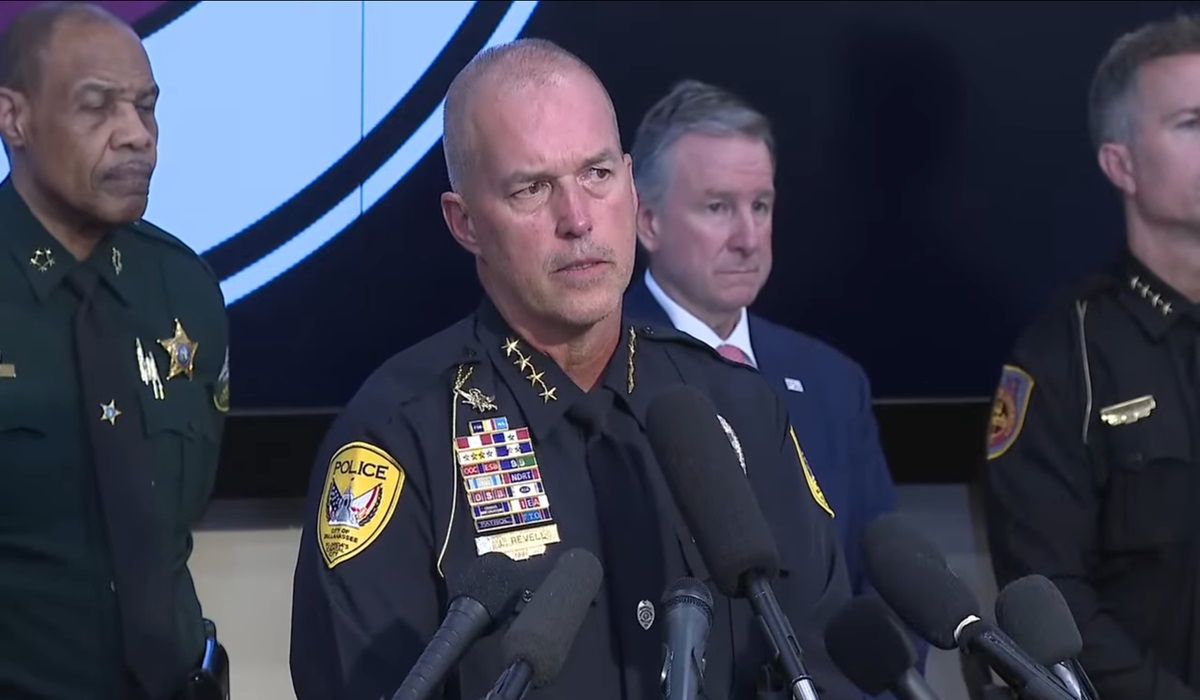

- Having claims locations conveniently spread out across Manitoba.

- No-fault insurance

- Coverage for everyone that drives a registered vehicle without being named on the registration

- Manitoba Drivers License comes with insurance

- The rental car policy is second to none

These are just some of the good aspects of MPI, and in many instances, the only type of coverage known to many Manitoba drivers. However, should they register their vehicle in another province, these coverages are only necessarily included in their registration if they pay an additional fee.

Coverage aside, MPI cannot continue to operate in a manner that is not in the best interest of all Manitobans. Case in point, there is an insightful article written in the Winnipeg Free Press by Journalist Dan Lett that talks about MPI diverting hundreds of millions of dollars from autopac’s rate reserve accounts to pay for non-autopac expenses.

Then there is Project Nova, MPI’s initiative to move auto insurance online, pegged at an initial cost of $86 million to Manitoba taxpayers, which has ballooned to a massive $290 million. The project was to be up and running for the spring of 2023, but only portions of it would be ready for Manitobans, specifically the commercial aspects of project Nova.

We must also remember the hundreds of Millions that have been paid out to Manitobans in the form of rebate cheques. And depending on who you speak to within the government, those rebate cheques were nothing to do with MPI overcharging Manitobans; they were more about giving back to Manitobans for good investment by the corporation.

There is a long list of grievances with MPI and public entities such as auto brokers for reducing commissions to the Automotive Trade Association of Manitoba (ATA) for alleged bullying tactics and unfair contract negotiations with collision centres.

As a monopoly, MPI’s contentious relationship with the public as the province’s sole provider of auto insurance may only change once the corporation changes some of its more undesirable practices. Until that happens, the criticism that the organization acts as both the judge and the jury when it comes to auto insurance claims is fitting. There needs to be more accountability and transparency in the way MPI operates. For that to occur, the must be extensive oversight of the corporation from the top down.

In regards to the mother and her hit-and-run claim, it is with all hopes her claim is adjudicated quickly in her favour so that she can move on from a horrible experience. Otherwise, the lack of trust and confidence in MPI can lead to delays and difficulties in resolving claims, further eroding Manitobans’ little faith in the Crown Corporation.