Government Announces $250 Rebate and Tax Break to Ease Cost of Living for Canadians

- Naomi Dela Cruz

- Canada

- November 21, 2024

Starting December 14, 2024, Canadians will benefit from a tax break designed to reduce the financial strain felt by many households. This new initiative, a temporary GST/HST exemption, will apply across the country and provide relief on a wide range of essential goods, including groceries, snacks, children’s clothing, and more. The tax-free status will extend to products such as prepared foods, restaurant meals, snacks, certain alcoholic beverages, children’s items, and even Christmas trees. This exemption will last until February 15, 2025, and aims to ease the cost of living for Canadians during the busy holiday season.

In addition to the tax break, the government is introducing the Working Canadians Rebate, which will provide a $250 payment to eligible Canadians who earned up to $150,000 in 2023. This rebate is expected to benefit approximately 18.7 million workers across the country. The payments will be issued starting in the spring of 2025. The rebate is positioned as a direct response to the challenges faced by middle-class workers as they continue to navigate inflation and rising costs.

The government is also calling on Parliament to swiftly pass the necessary legislation to ensure the prompt delivery of both the tax relief and the rebate. This move comes as many Canadian families prepare for the holiday season, which is often marked by increased expenses.

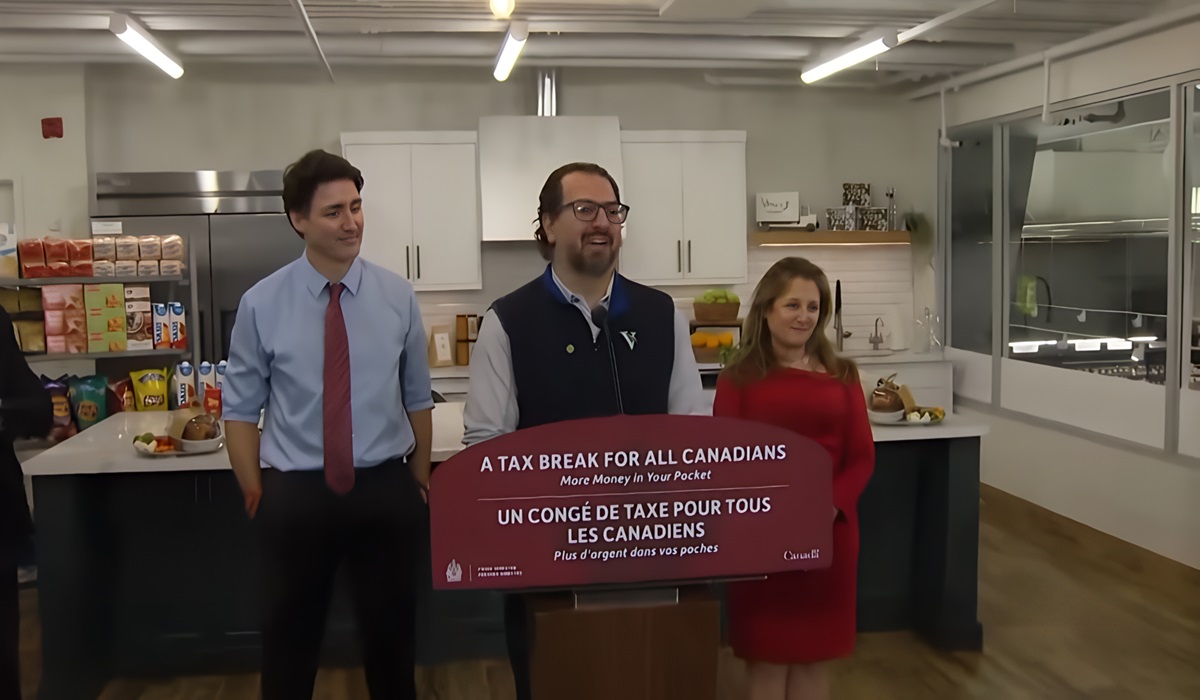

Prime Minister Justin Trudeau emphasized that while the government cannot control prices, it can provide financial support to help Canadians manage their day-to-day costs. Deputy Prime Minister and Finance Minister Chrystia Freeland noted that this new initiative would offer relief when expenses are highest, helping families enjoy the holidays without the added stress of rising costs.

This measure is part of a broader strategy by the government to reduce financial burdens on Canadians, which includes initiatives like the National School Food Program and the Canada Child Benefit. These programs are already providing substantial savings for families and individuals across the country.