Major Amendments to Income Tax Regulations

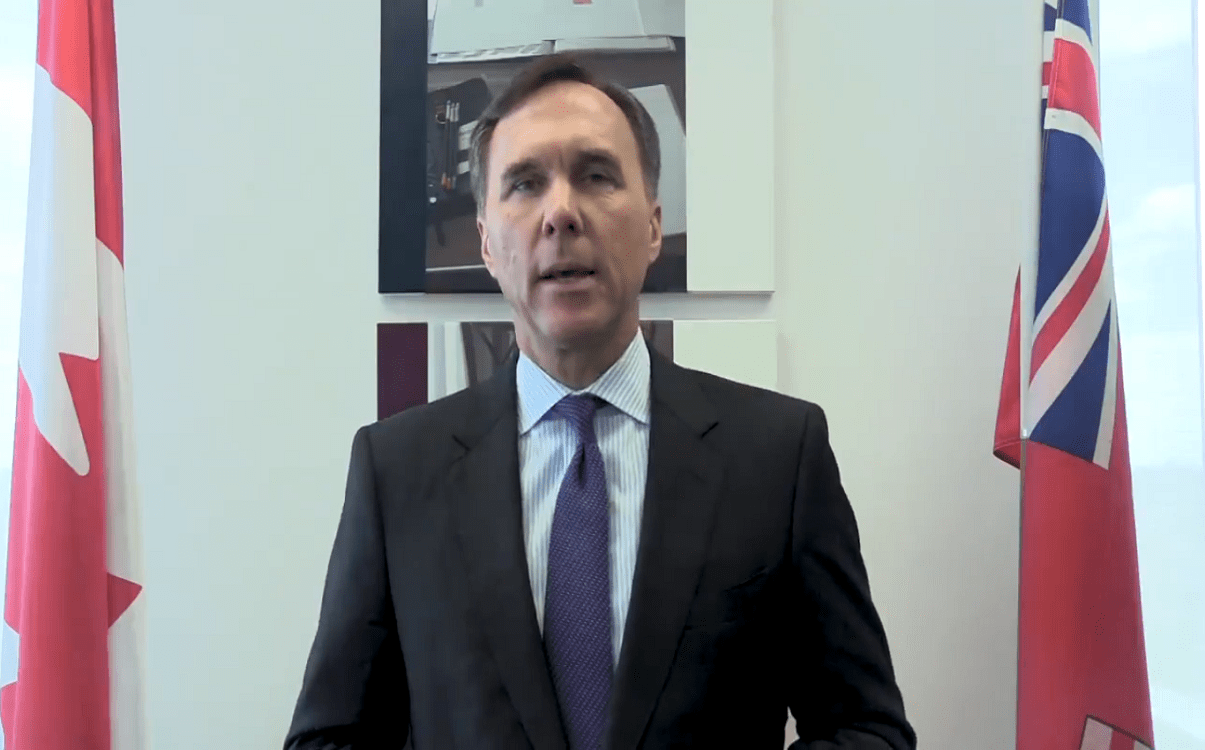

As the Canadian Government continues to take immediate, significant and decisive action through Canada’s COVID-19 Economic Response Plan to support Canadians and protect jobs during the global COVID-19 outbreak, finance Minister Morneau made a welcomed announcement to the likes of pensioners.

Today, Morneau announced the release of draft regulations that would help employers who sponsor a Registered Pension Plan (RPP) or salary deferral leave plan for their employees to manage and maintain their benefit obligations through the crisis. It will also assure employees who participate in salary deferral leave plans that suspending their leave of absence (e.g., via a recall to essential-service work), or deferring their scheduled leave for up to one year, will not put their plan at risk.

“COVID-19 has proven that extraordinary challenges demand extraordinary actions. The temporary relief we will provide to registered pension plan sponsors and their beneficiaries will play an important role in supporting them through these challenges and in positioning them for a strong recovery.”– Bill Morneau, Minister of Finance

The proposed draft regulations would support the effective administration of such plans through the COVID-19 pandemic, providing temporary relief from various registration rules and other conditions that must be complied with under the Income Tax Regulations by:

- adding temporary stop-the-clock rules to the conditions applicable to salary deferral leave plans for the period of March 15, 2020 to April 30, 2021;

- removing restrictions that prohibit an RPP from borrowing money;

- extending the deadline for decisions to retroactively credit pensionable service under a defined benefit plan or to make catch-up contributions to money purchase accounts;

- permitting catch-up contributions to RPPs to be made in 2021 to the extent that 2020 required contributions had been reduced;

- setting aside the 36-month employment condition in the definition “eligible period of reduced pay” for the purpose of using prescribed compensation to determine benefit or contribution levels; and

- allowing wage rollback periods in 2020 to qualify as an eligible period of reduced pay for prescribed compensation purposes.

These proposed measures are part of the Government of Canada’s COVID-19 Economic Response Plan to help Canadians and keep the economy from falling into a recession.