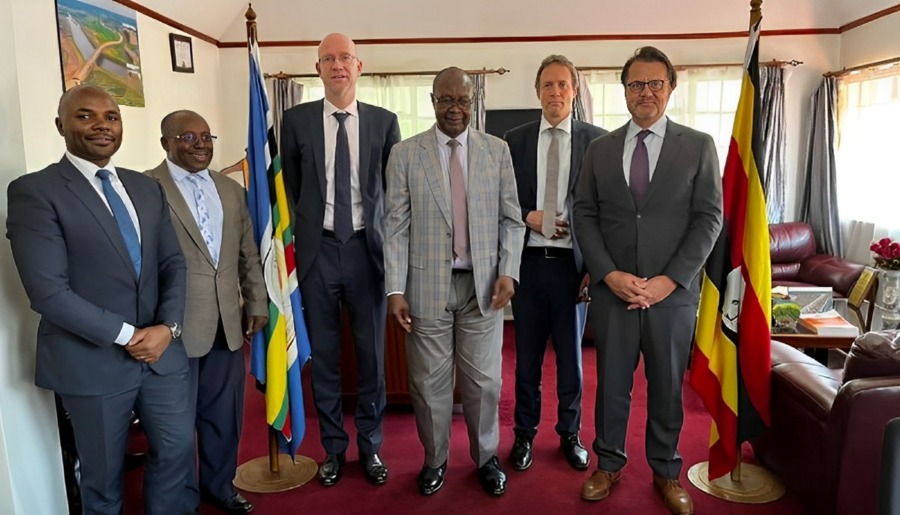

A European Investment Bank (EIB) delegation recently embarked on a week-long visit to Uganda to engage with key stakeholders and discuss potential investment opportunities in the country. Led by Edward Claessen, the Head of the EIB Regional Hub for Eastern Africa, the delegation aimed to explore avenues for collaboration and growth, supporting the European Union’s Global Gateway initiative. EIB Global aims to provide long-term financing and address investment gaps to expedite impactful projects that contribute to sustainable development while adhering to technical, social, and environmental standards.

During his visit, Edward Claessen acknowledged Uganda’s enormous potential but highlighted the significant investment requirements faced by the country. These needs have been further compounded by the COVID-19 pandemic, energy challenges, and inflation shocks triggered by external factors such as Russia’s invasion of Ukraine. Claessen emphasized that the Ugandan government needs the support of partners like the European Union and the EIB to facilitate economic recovery, sustained growth, job creation, funding, and investment.

Jan Sadek, the EU Ambassador to Uganda, warmly welcomed the EIB delegation’s visit and emphasized the crucial role that EIB Global, as part of #TeamEurope, plays in fostering sustainable growth in Uganda. He underlined the European Union’s commitment to supporting Uganda’s pressing needs by promoting sustainable development through sound economic policies and good governance.

EIB Global has already made significant investments in Uganda, providing over EUR 498 million (UGX 2 trillion) for 31 projects. These investments primarily targeted private sector businesses, energy, water, sewerage, transport, industry, telecom, services, agriculture, fisheries, and forestry. Notable projects include the Eastern Africa Transport Corridor project, the Bujagali Hydroelectric Project, and the Lake Victoria water and sanitation project in Kampala.

EIB Global’s priority activities in Uganda are designed to address crucial challenges. The organization focuses on supporting climate adaptation and mitigation projects that enhance the resilience of vulnerable communities. Additionally, EIB Global aims to improve access to finance, particularly for small and medium-sized enterprises (SMEs) and micro-enterprises, thereby stimulating economic growth and job creation.

EIB Global collaborates with banks, microfinance institutions, equity funds, and other non-banking financial institutions, recognizing the importance of strong financial intermediaries in addressing market challenges. The objective is to innovate and expand the reach and inclusiveness of these institutions, enabling greater support to underserved smaller businesses. EIB Global has provided over EUR 203 million (UGX 815 billion) to support private sector businesses in Uganda, with a specific focus on agriculture and gender-equality projects.

In addition to financial support, EIB Global offers technical assistance to partner banks, microfinance institutions, and their clients. This assistance covers various topics, including risk management, product development, environmental and social assessment, and financial literacy. By providing this support, EIB Global enhances the capacity and effectiveness of its partners, ultimately contributing to sustainable development in Uganda.

EIB Global has been steadily increasing its investments in Africa, accounting for nearly 40% of all investments outside the European Union. This highlights the EIB’s commitment to fostering growth and development in Africa by actively participating in high-impact projects that align with the EU’s Global Gateway strategy.

EIB Global aims to contribute to Uganda’s sustainable development through investments in key sectors, technical assistance, and collaboration with local financial institutions. The partnership between the EIB and Uganda reflects a shared vision of fostering inclusive and environmentally sound growth while addressing pressing challenges and unlocking the country’s vast potential.