COVID-19 Payroll Relief For Canadians With LEEFF Program. The LEEFF Program will immediately help payroll

COVID-19 has altered the way we live our lives and, every day, Canadians are facing new challenges during this crisis. As more people worry about paying their bills and caring for their loved ones, the Government of Canada is continuing to take unprecedented action to help protect middle-class jobs, and the health and safety of all Canadians.

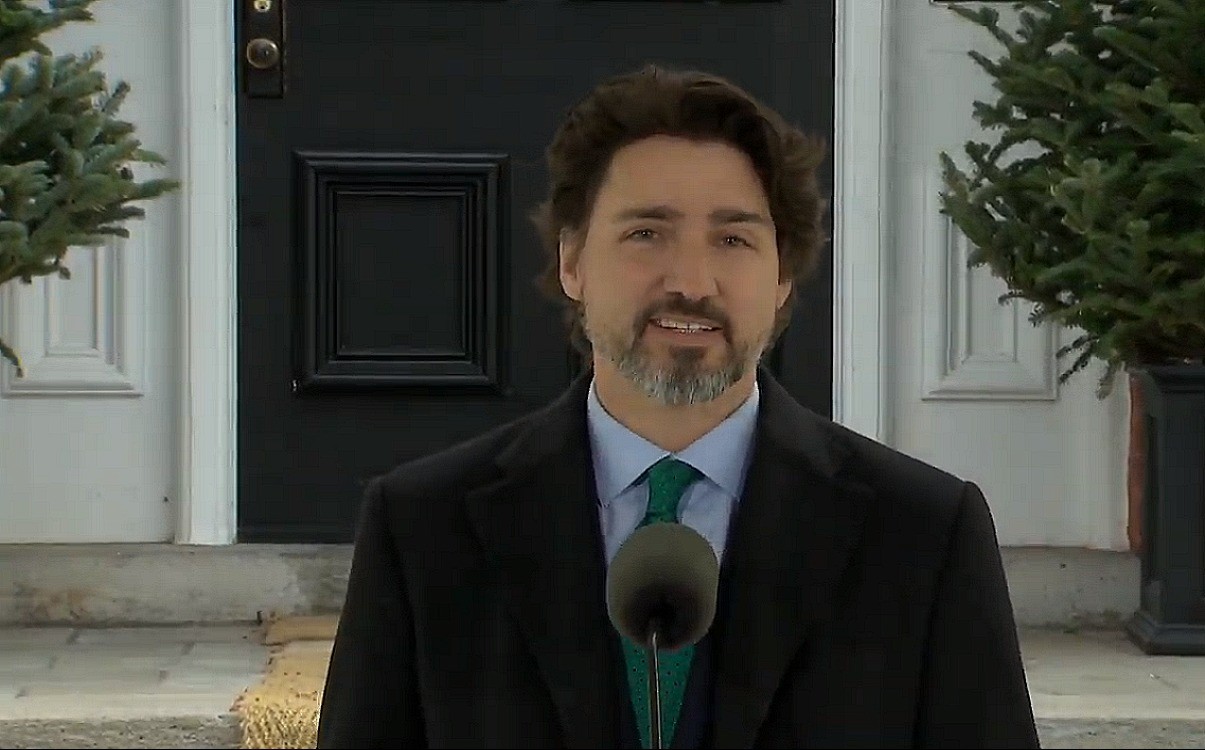

“We know that times have been tough, and Canadians are concerned about their jobs, and the health and safety of their families. We promised that we would be here to support all Canadians, and that is why we are announcing new measures that will help save middle class jobs, safeguard workers’ benefits, and protect our economy. This will help businesses keep workers on the payroll, and put more Canadians in a position to recover quickly once we make it through these uncertain times.”The Rt. Hon. Justin Trudeau, Prime Minister of Canada

Millions of Canadians pay their bills and feed their families by working for large and medium-sized businesses. Today, Prime Minister Trudeau announced the establishment of a Large Employer Emergency Financing Facility (LEEFF) to provide bridge financing to Canada’s largest employers, whose needs during the pandemic are not being met through conventional financing, in order to keep their operations going.

The new measures are aimed at providing support to businesses so they can keep their workers on the payroll and weather the pandemic.

The objective of this support is to help protect Canadian jobs, help Canadian businesses weather the current economic downturn, and avoid bankruptcies of otherwise viable firms where possible. This support will not be used to resolve insolvencies or restructure firms, nor will it provide financing to companies that otherwise have the capacity to manage through the crisis. The additional liquidity provided through LEEFF will allow Canada’s largest businesses and their suppliers to remain active during this difficult time, and position them for a rapid economic recovery.

Companies seeking support must demonstrate how they intend to preserve employment and maintain investment activities. Recipients will need to commit to respect collective bargaining agreements and protect workers’ pensions.

The LEEFF program will require strict limits to dividends, share buy-backs, and executive pay. In considering a company’s eligibility to assistance under the LEEFF program, an assessment may be made of its employment, tax, and economic activity in Canada, as well as its international organizational structure and financing arrangements.

The program will not be available to companies that have been convicted of tax evasion. In addition, recipient companies would be required to commit to publish annual climate-related disclosure reports consistent with the Financial Stability Board’s Task Force on Climate-related Financial Disclosures, including how their future operations will support environmental sustainability and national climate goals. These measures are put in place to protect the Canadian Tax Payers.

Fairness: To ensure support across the Canadian economy, the financing is intended to be applicable to all eligible sectors in a consistent manner.

Timeliness: To ensure timely support, the LEEFF program will apply a standard set of economic terms and conditions.

The Government has also expanded the Business Credit Availability Program (BCAP) to mid-sized companies with larger financing needs. Support for mid-market businesses will include loans of up to $60 million per company, and guarantees of up to $80 million. Through the BCAP, Export Development Canada (EDC) and the Business Development Bank of Canada (BDC) will work with private-sector lenders to support access to capital for Canadian businesses in all sectors and regions.

In a previous announcement, the Federal Government made financial commitments to farmers through Farm Credit Canada, the BDC, and EDC, including through the Canada Account. This will ensure the government is able to respond to a wide range of financing needs, including for some large employers facing higher risks, with stricter terms in order to adequately protect taxpayers.

The government’s support for large companies through LEEFF will be delivered by the Canada Development Investment Corporation (CDEV), in cooperation with Innovation, Science and Economic Development Canada (ISED) and the Department of Finance.

The LEEFF program will be open to large for-profit businesses – with the exception of those in the financial sector – as well as certain not-for-profit businesses, such as airports, with annual revenues generally in the order of $300 million or higher.

To qualify for LEEFF support, eligible businesses must be seeking financing of about $60 million or more, have significant operations or workforce in Canada, and not be involved in active insolvency proceedings. Broader sectoral dynamics for LEEFF applicants will be considered through processes led by ISED.

The LEEFF program will be designed to protect the interests of taxpayers and will require the cooperation of applicants’ private-sector lenders, to ensure government financing is focused on sustaining operations.

The government is in the final stages of establishing the program and further information about the application process will be provided shortly.

Also, Worth Reading

Heritage Canada Announced $500M To Support Sports & Culture