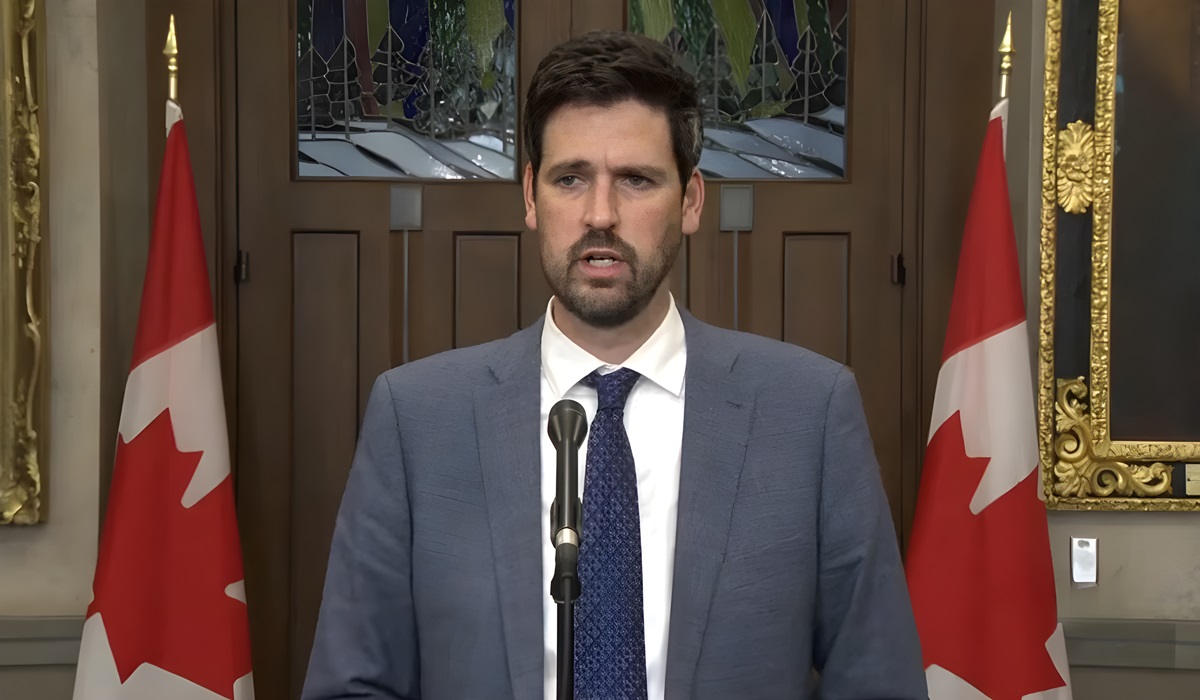

Canadian Parliament Convenes To Pass Emergency Act, No.2. Bill Morneau introduced in Parliament Bill C-14

Finance Minister Bill Morneau introduced in Parliament Bill C-14, The COVID-19 Emergency Response Act, No. 2, which, upon receiving Royal Assent, would bring this measure into law. The legislation introduced in Saturday’s emergency session includes additional flexibilities that would provide effective support to those eligible employers that are hardest hit by the COVID-19 pandemic and would help protect the jobs Canadians depend on during these difficult times.

“With the Canada Emergency Wage Subsidy, we are making sure to support Canadian businesses and Canadian workers through this crisis, ensuring they are well-positioned to recover quickly when the COVID-19 pandemic is over. We will continue to do whatever it takes to ensure Canadians are supported through the outbreak, and that our economy remains resilient during these difficult times.”

Bill Morneau, Minister of Finance

Taking action to protect a strong economy includes taking action to protect jobs. The proposed CEWS is a key measure in the Government of Canada’s COVID-19 Economic Response Plan. It would provide a strong incentive for employers to pay employees who have been sent home for health and safety reasons or due to lack of work. It would enable employers to retain employees who are still on the payroll and to rehire workers previously laid off. With the CEWS program, families across Canada would be able to count on a steady income.

The proposed CEWS would apply at a rate of 75% of the first $58,700 earned by employees – representing a benefit of up to $847 per week, per employee. The program would be in place for a 12-week period, from March 15 to June 6, 2020. Employers of all sizes and across all sectors of the economy would be eligible, with certain exceptions including public sector entities. Flexibility in the measurement of revenue for the purpose of applying the revenue decline test would also ensure more consistent access to the wage subsidy across impacted organizations, including newly created businesses and high-growth companies, as well as non-profit organizations and registered charities.

An eligible employer’s entitlement to this wage subsidy would be based on the salary or wages actually paid to employees. All employers would be expected to at least make best efforts to bring employees’ wages to their pre-crisis levels.

Bill C-14 introduced today includes proposed improvements to the Canada Emergency Wage Subsidy that were announced in detail on April 8, 2020 and subsequently refined as part of the legislative process. These improvements include the following:

- To measure their revenue loss, it is proposed that employers compare their revenue of March, April and May 2020 to that of the same month of 2019 or, in order to provide added flexibility, to an average of their revenue earned in January and February 2020.

- For March, the government proposes to make the CEWS more accessible than originally announced by reducing this 30% benchmark to 15%, in recognition of the fact that many businesses did not begin to be affected by the crisis until partway through the month.

- To provide certainty for employers, the government is also proposing that once an employer is found eligible for a specific period, they would automatically qualify for the next period of the program. For example, an employer with a revenue drop of more than 15% in March would qualify for the first and second periods of the program, covering remuneration paid between March 15 and May 9. Similarly, an employer with a revenue drop of 30% in April would qualify for the second and third periods of the program, covering remuneration paid between May 10 to June 6.

- To recognize the challenges in measuring revenues of non-profit organizations and registered charities, it is proposed that they be allowed to choose whether or not to include government assistance in revenues for the purpose of applying the revenue decline test. Once chosen, the same approach would have to be maintained by the organization throughout the program period.

- It is also proposed that employers be allowed to measure revenues either on the basis of accrual accounting (as they are earned) or cash accounting (as they are received). Once chosen, the same accounting method would have to be used by the employer throughout the program period.

- It is also proposed that the CEWS provide an additional amount to compensate employers for their contributions to the Canada Pension Plan, Employment Insurance, Quebec Pension Plan and Quebec Parental Insurance Plan paid in respect of eligible employees who are on leave with pay due to COVID-19.

In order to maintain the integrity of the program and to ensure that it helps Canadians keep their jobs, the employer would be required to repay amounts paid under the CEWS if they do not meet the eligibility requirements.

The government is also proposing a penalty of 25% of the CEWS received by an employer if the employer has engaged in transactions that artificially reduce the employer’s revenue in order to qualify for the subsidy. As well, under existing provisions of the Income Tax Act, persons making, or participating in making, a false or deceptive statement could be prosecuted with a summary or indictable offence. Anyone found guilty could be sentenced to prison for up to 5 years.

The government will continue to carefully monitor all developments relating to the COVID-19 outbreak and will continue to take further action to protect Canadians and the economy.

You May Also Like

Canada Launches $65 Billion Emergency Business Loans