Bessent’s Blunder: Treasury Chief Defends an Economic Strategy That’s Burning the House Down

- TDS News

- U.S.A

- April 13, 2025

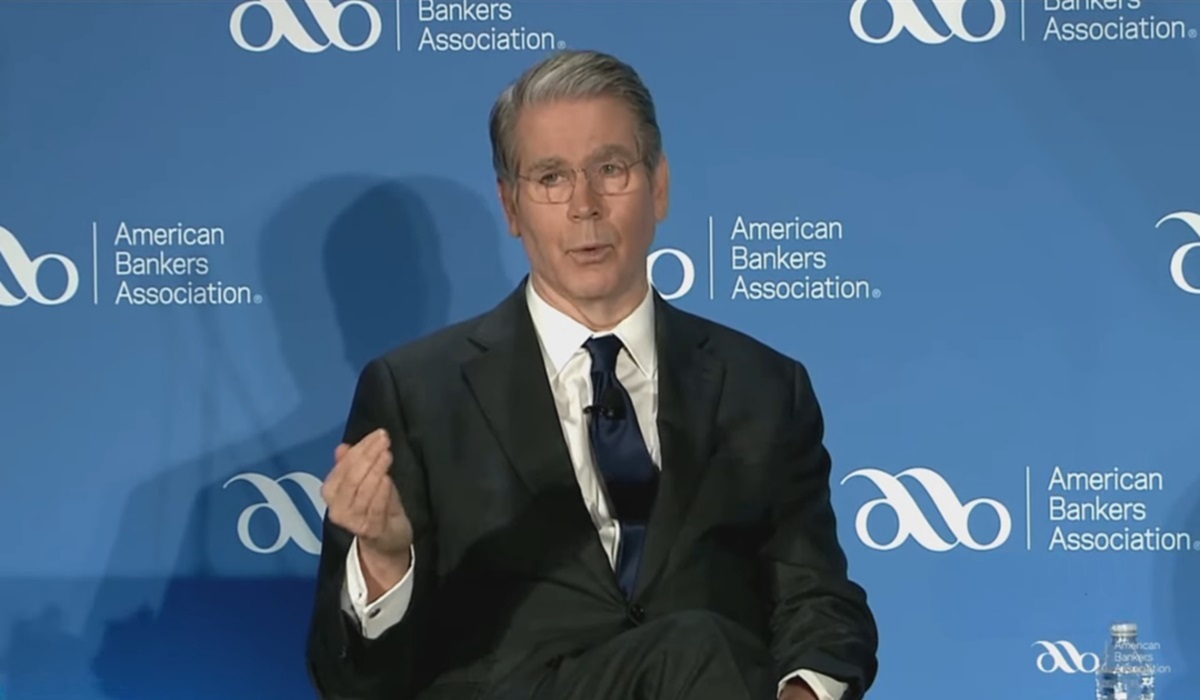

In what can only be described as a stunning abandonment of economic responsibility, U.S. Treasury Secretary Scott Bessent has thrown the full weight of his office behind the White House’s trade rhetoric—a policy direction so hostile, so drenched in arrogance, it’s actively dismantling the very markets he was appointed to protect.

Let’s call it what it is: the current U.S. trade stance is not a strategy, it’s a threat. It operates on a crude premise—that the United States should be free to impose tariffs on whomever it wants, whenever it wants, with zero expectation of pushback. And if that pushback comes? The answer from Washington is to punch harder. Bessent may not have coined this playground logic, but he’s certainly repeating it with alarming frequency.

This posture isn’t just reckless—it’s economically suicidal. The U.S. bond market is hemorrhaging. Global confidence in American stability is wavering. And while the stock market may show brief glimmers of recovery, those upticks are nothing more than temporary mirages in an otherwise collapsing desert. Trillions in value have been wiped off the board. American jobs are being lost by the hundreds of thousands, and the only consistent message from Bessent’s camp is: more of the same.

The Treasury Secretary’s role is supposed to be one of prudence, not provocation. Bessent’s predecessors have worked to calm markets in times of uncertainty, to reassure investors that American economic leadership meant foresight and fairness. Today, under Bessent, it means escalation. It means turning economic disagreements into full-blown confrontations. And it means pretending that when the U.S. hits others, they should simply stand there and take it.

That’s not how trade works. That’s not how diplomacy works. That’s not how the real world works.

Every sovereign nation has the right—the obligation—to respond to punitive tariffs. Retaliation isn’t aggression; it’s a matter of economic survival. Countries like China, Brazil, and the European Union aren’t retaliating because they’re picking fights. They’re responding to one. And their countermeasures are entirely justified in the face of an American administration that thinks it can bludgeon its way to better terms.

If Bessent truly believes that this zero-sum approach will strengthen America, he’s ignoring a century of evidence to the contrary. Protectionism doesn’t lift economies—it cages them. And it doesn’t make allies—it isolates them. The same goes for the markets: capital doesn’t flow toward volatility. It flees from it. And right now, the U.S.—once the surest bet in global finance—is looking increasingly like the world’s riskiest.

The irony is rich. An administration that screams “America First” is pushing policies that put Americans last—last in job security, last in global trust, and last in economic resilience. The markets are reacting. The world is reacting. But the Treasury Secretary continues to defend policies that threaten to turn a trade dispute into a generational collapse.

Bessent’s name may not be the loudest in the room, but make no mistake—his fingerprints are all over this disaster. Whether by design or by complicity, he is standing by while the dollar is destabilized, trade partners are alienated, and the U.S. reputation as a reliable economic partner is torn to shreds.

This isn’t strength. It’s hubris. It’s a bluff that no one is buying anymore.

If there is still time to change course, Bessent must find the courage to tell the truth—to the President, to the markets, and to the American people. Because continuing down this road won’t end with better deals or fairer trade. It will end with collapse. And when the dust settles, the history books won’t be kind to the man who sat at the Treasury and watched it all burn.