2021 Provincial Tax Change Creates A New $500 Credit For Parents

- TDS News

- Atlantic Canada

- December 31, 2020

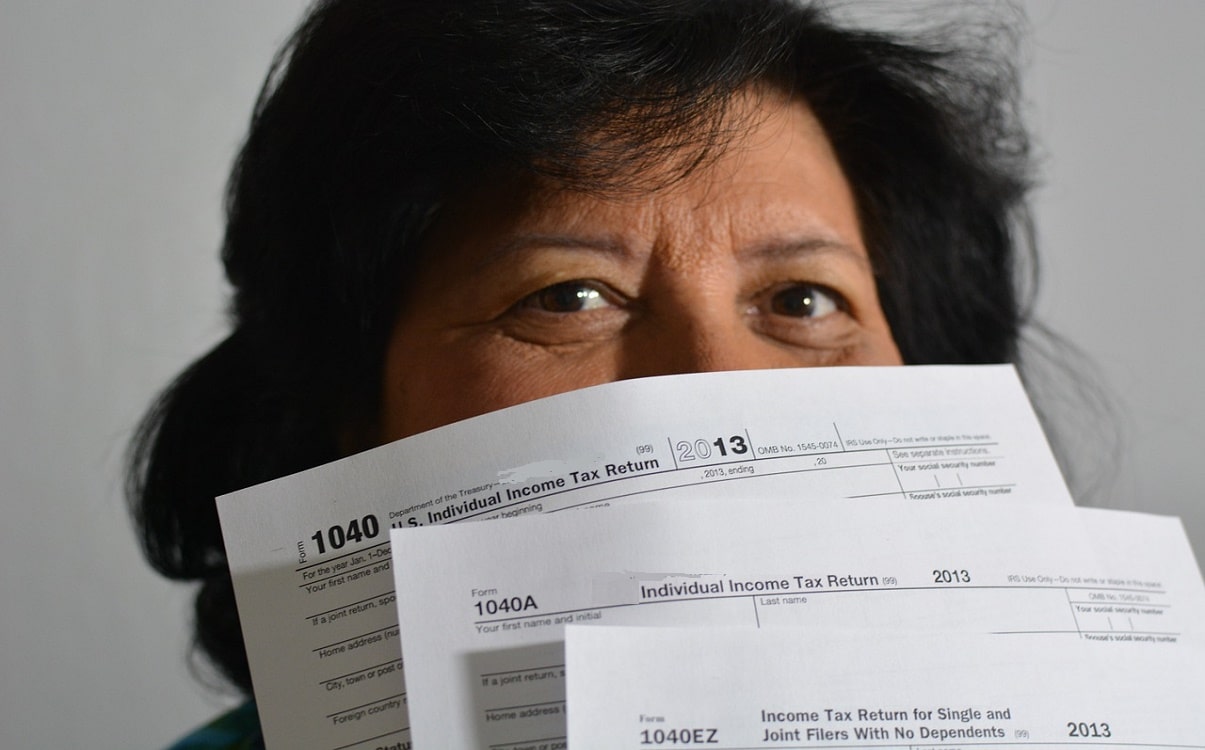

The $500 Children’s Wellness tax credit will help families in Prince Edward Island

A number of tax changes announced within the 2020-2021 Operating Budget will leave more money in the hands of Islanders and businesses now when they need it most.

The changes include the increase of the Low-Income Reduction Threshold from $18,000 to $19,000, the increase in the Basic Personal Amount from $10,000 to $10,500, and a reduction in the Small Business Tax from 3 per cent to 2 per cent, effective January 1, 2021.

“These tax changes will help keep more money in the pockets of Islanders,” said Minister of Finance Darlene Compton. “As we continue to recover from the effects of the pandemic, Islanders will have more money to spend on their priorities.”

“The COVID-19 pandemic has greatly impacted our business community, and these new tax changes will assist them, as we continue to support local and renew our economy, together.

New this upcoming year is the $500 Children’s Wellness tax credit that parents and guardians can claim for their children’s activities throughout the year to promote their wellness.