159 Countries Sign Onto BRICS Settlement System, Bypassing SWIFT

- TDS News

- Breaking News

- August 19, 2024

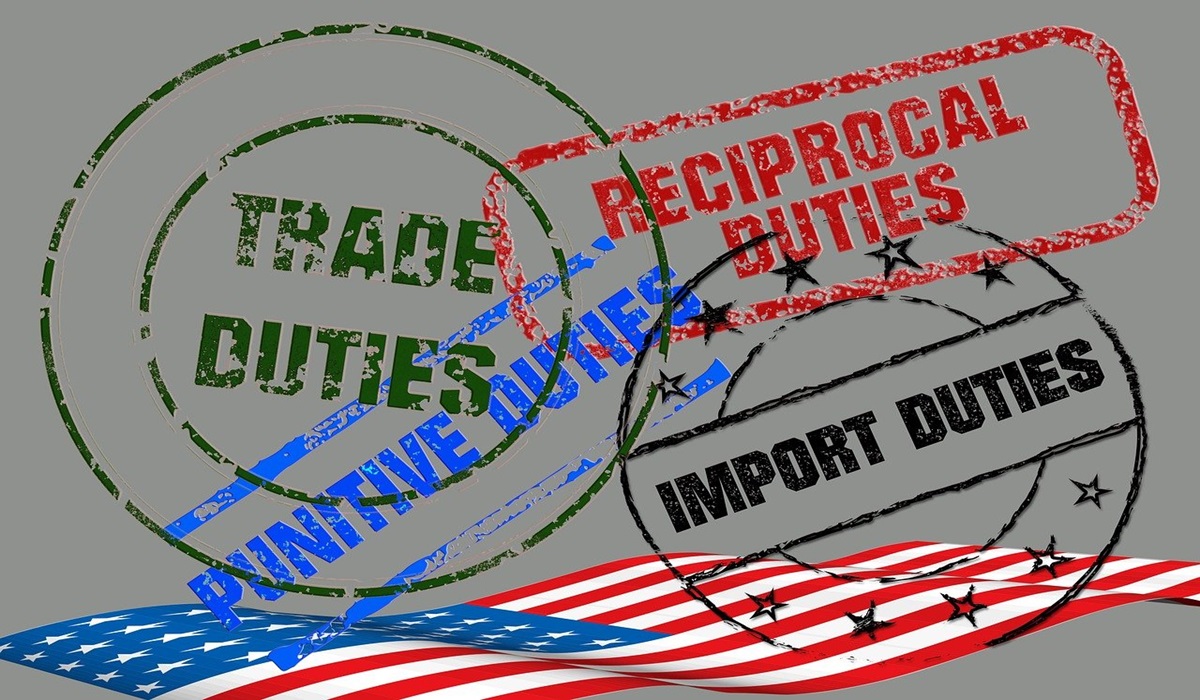

Image Credit, Limassol/Cyprus

The global financial landscape is poised for a seismic shift as news emerges that 159 out of 193 countries have signed up to use the new BRICS settlement system, a direct rival to the SWIFT system. SWIFT, the longstanding international payment network, has been a critical tool in global finance, allowing secure and standardized financial transactions across borders. However, its role as a weapon of economic sanctions has led to its vulnerability, particularly for nations like Russia, Iran, and several African countries, which have faced severe sanctions imposed by the U.S. and some European nations. These sanctions have effectively frozen billions in assets, locking out these countries from the global financial system and crippling their ability to transact with other nations.

In response to these financial restrictions, the BRICS nations, which include Brazil, Russia, India, China, South Africa and its new members, have developed a new system designed to bypass the need for SWIFT entirely. The significance of this development cannot be overstated. The new settlement system not only provides an alternative means for countries to conduct international transactions without fear of sanctions but also marks a significant step towards the de-dollarization of the global economy. This system allows countries to settle trades and payments in their own currencies, reducing reliance on the U.S. dollar, which has long been the dominant global currency.

This move is particularly momentous as it addresses the growing concerns among nations about the risks associated with holding and trading in dollars, especially under the threat of sanctions that could result in asset confiscation. By enabling transactions in local currencies, the new system not only protects national economies from the volatility of the dollar but also promotes greater financial sovereignty and stability.

As the BRICS system prepares to go live in October, coinciding with the next meeting of BRICS nations in Russia, it signals a significant shift in global economic power. The combined economic might of the BRICS nations now surpasses that of the G7 and G20, and with a growing list of countries eager to join this coalition, the implications for the U.S. dollar are profound. The potential erosion of the dollar’s status as the world’s reserve currency could lead to a reconfiguration of the global financial order, challenging the hegemony that the U.S. has long enjoyed.

For the U.S., the rise of this alternative settlement system poses a direct challenge to its economic influence. The dominance of the dollar has been a cornerstone of American power, facilitating its ability to impose sanctions and influence global financial flows. However, as more countries opt for the BRICS system, the demand for dollars in international trade could decline, weakening the dollar’s value and reducing the U.S.’s leverage over global markets.

This transition also reflects broader geopolitical shifts, with countries increasingly seeking to assert their independence from Western-dominated financial institutions. The emergence of this system is not just a technical development but a statement of intent by many nations to challenge the existing economic order. The growing alignment of these countries under the BRICS banner signals a move towards a more multipolar world, where financial and economic power is more evenly distributed.

As the world watches the rollout of the new BRICS system, the implications for global finance, trade, and the geopolitical landscape are enormous. This development marks a potential turning point in the history of international economics, as the global balance of power shifts away from the traditional centers of influence and towards a more diverse and distributed network of economic partnerships. The coming months will be critical in determining how this new system is adopted and how it impacts the longstanding dominance of the U.S. dollar in global finance.